The budgetary allotment may rise this time in the Prime Minister Housing Scheme - Urban (PM Awas Yojana Urban), which has begun to provide slums, kutcha houses, or individuals living on lease in metropolitan regions. Government sources say that this serves a considerably a lot to the government inclinations. To start with, the individuals who don't have their own home will get a house. Also, it sets out the business to open doors for many individuals. The economy is gained by building extra houses, which is extraordinary.

The Pradhan Mantri Awas Yojana, which began in metropolitan regions so far for slums, kutcha houses, or individuals living on a lease, can increment budgetary distribution this time in metropolitan zones. This is with the goal that the objective of giving lodging to all continuously in 2022 can be met. Tell us what is happening toward this path: -

What amount of allotment can be expanded?

Sources related to the Union Urban Development Ministry said that the goal of the public authority has consistently been to give lodging to however many individuals as could be expected under the circumstances. In a year ago's financial plan, an allotment of Rs 8,000 crore was made for the Pradhan Mantri Urban Housing Scheme. Afterward, an extra portion of Rs 18,000 crore was made for it in November last. This year, it is accepted that more than a year ago's portion is to be given for this plan. Be that as it may, he didn't say how much add up to be given for the current year.

What is the Prime Minister's Urban Housing Scheme?

The Prime Minister Urban Housing Scheme was dispatched by Prime Minister Narendra Modi on 25 June 2015 for monetarily more vulnerable segments, low-pay gatherings, and helpless groups of center pay living in metropolitan zones of the country. This plan covers people who don't possess or have lived in a kutcha house. Under this plan, advances are given at a concessional rate to give them their own pucca house.

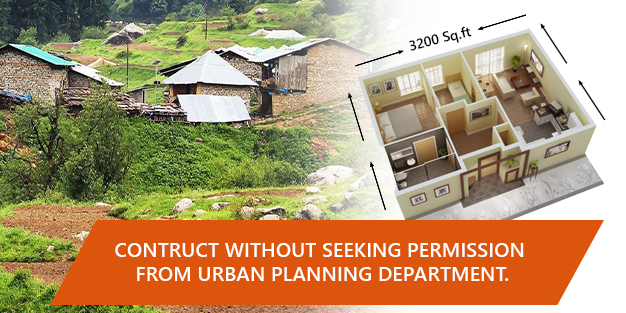

What is the reason for the PM Urban Housing Scheme?

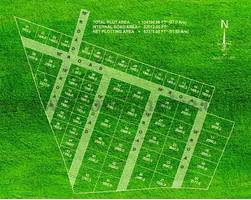

The fundamental target of this plan is to give pucca house offices to the metropolitan destitute individuals of the country who don't have a pucca house to live in or are destitute. The objective of the focal government under this plan is to give its own home to each qualified family constantly in 2022. Till that point, an objective has been set to build 2 crore pucca houses for the helpless segments. The public authority is attempting to fabricate pucca houses in chosen urban areas with the assistance of developers. The houses gave under this plan will be claimed mutually by a grown-up female part or with guys.

Who has joined this plan?

Under the Pradhan Mantri Awas Yojana list, those recipients who had applied online under the Pradhan Mantri Awas Yojana as of late. All reports of recipients have been confirmed by the Central Government and their names have been remembered for the Prime Minister's Housing Scheme list. Any inhabitant of the country who has applied under PMAY can undoubtedly discover his/her name on the PMAY list.

What amount of help do you get?

The recipients, whose name will be selected for the PMAY metropolitan rundown, will be given by the government at loan costs going from Rs 2.35 lakh to Rs 2.50 lakh unexpectedly purchasing their own home. Under the plan, advances up to Rs 6 lakh will be made accessible for monetarily more to weak segments and low-pay bunches for a time of 20 years, and under the plan, an appropriation of 6.50 percent for example Rs 2.67 lakh will be given on the credit. People of MIG 1 and MIG 2 gatherings will be given 4 percent and 3 percent interest on 20-year advances. Altogether, MIG 1 and MIG 2 are giving an appropriation of Rs 2.35 lakh and Rs 2.30 lakh to the gathering.

What is the pay classification under the Pradhan Mantri Awas Yojana List?

Three classifications of individuals are given credits under the Pradhan Mantri Awas Yojana. This classification is resolved by the yearly pay of individuals.

Monetary Weaker Section: All those individuals are covered under Economic Weaker Section, whose yearly pay is Rs. 3,00,000 or less. Under the Pradhan Mantri Awas Yojana, credits are given to individuals having a place in the financially more vulnerable area.

The accompanying pay gatherings: All the individuals who fall under the lower pay gathering, have a yearly pay going from Rs 3,00,000 to Rs 6,00,000. Advances are additionally given to individuals of the lower-pay bunches under Pradhan Mantri Awas Yojana.

Center Income Group: Under the center pay gathering, every one of those whose yearly pay is from Rs 6,00,000 to Rs 18,00,000. Credits are additionally given to individuals from the center pay bunches under PM Awas Yojana.